Computation of return of investment

Among other places its used in the theory of stock valuation. This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in Bond face value Bond price Coupon rate and years to.

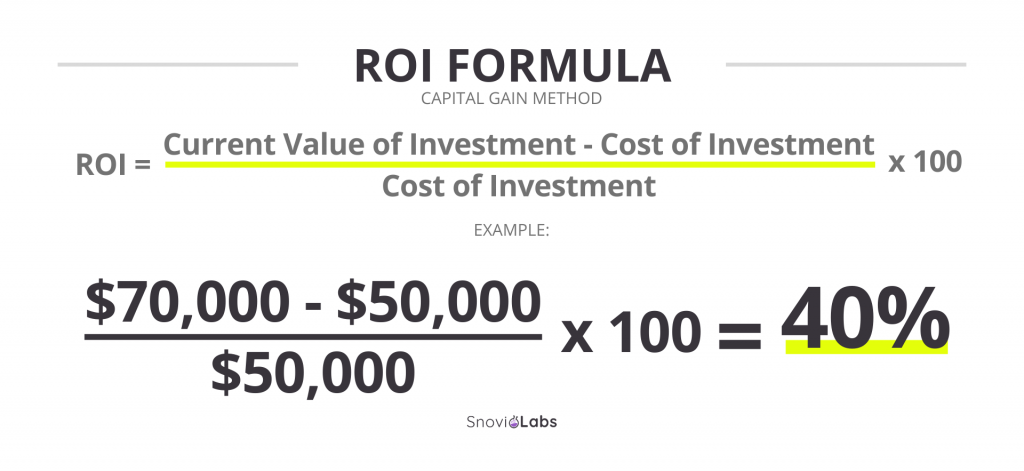

What Is Roi Definition Formulas And Tips Snov Io

Waters Edge Foreign Investment Interest Offset.

. For more information see the Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts. PDF On Jan 1 1999 Prof. It is usually distributed to stockholders after a profitable year or quarter.

ITR of the latest 3 years not filed in the same year. Present value is compound interest in reverse. Yield to Maturity Calculator is an online tool for investment calculation programmed to calculate the expected investment return of a bond.

Publicly disclosing on its annual information return information relating to grants above 5000. Cumulative Growth of a 10000 Investment in Stock Advisor Calculated by Time-Weighted Return since 2002. No computation of expected return is made based on your.

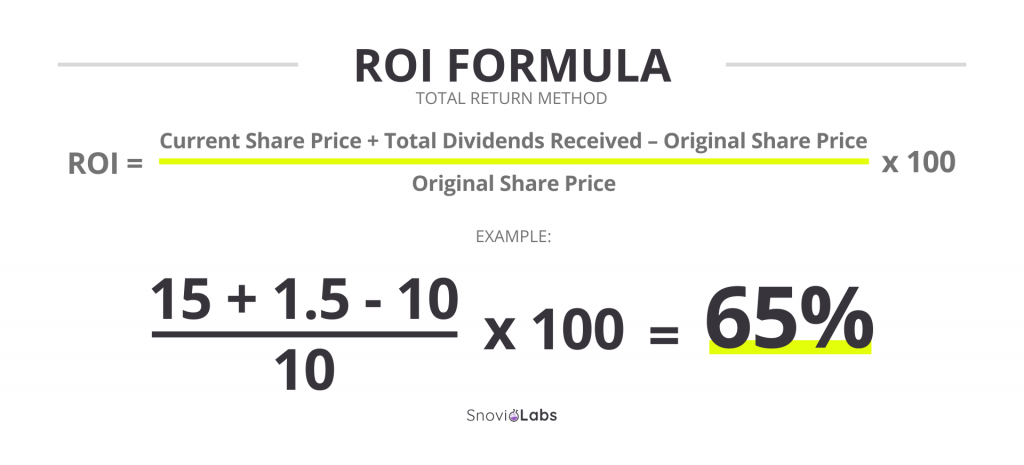

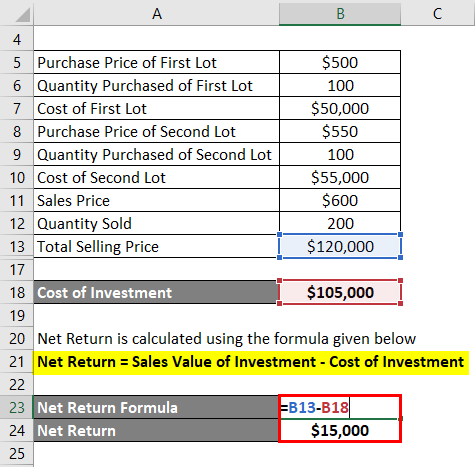

The difference from capital gain is that this computation considers the original and current share prices and any dividends. Most often you use it to measure the net income for that investment. Consider the following scenario that we will use to highlight the different computation methods using the fictitious.

As a result the company revised the computation of the deferred tax liability. Check out the simple guide to file ITR Income Tax Return 5 form for AY 2022-23. Finding the amount you would need to invest today in order to have a specified balance in the future.

National Population Register containing details of address name and aadhaar number. Year that precedes the first taxable year in which the taxpayer derives more than 25000 in gross receipts other than investment income. There are many reasons why dividends are declared but here are three examples.

Investment Tax Credit for Carbon Capture Utilization and Storage-35. A retail clothing business submits an application for a loan from a community bank on February 1 2016. Initial Return Consolidated Return PART I COMPUTATION OF INCOME TAX LIABILITY 30911069 Complete Schedule M - - - - Amended Return Check if.

It analyzes an investment project by comparing the internal rate of return to the minimum required rate of return of the company. Individual Tax Return Form 1040 Instructions. Founded by former senior executives from Garrison Investment Group Machine Investment Group is a real estate investment platform focused on opportunistic distressed and special situations across the United States.

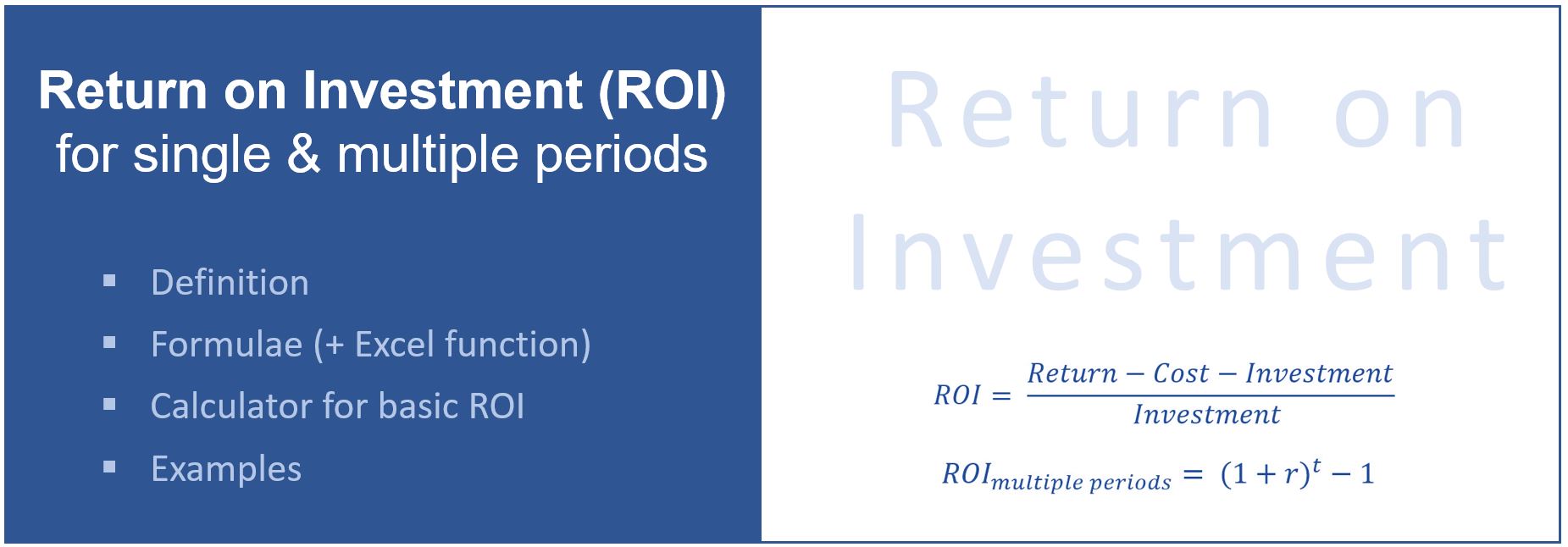

Attach complete copy of federal return. Distributions from an annuity under a nonqualified plan are considered net investment income for the purpose of figuring the NIIT. Computation only pays attention to the return values and applies a comparison concept when analyzing the performance of more than a single investment over multiple time periods.

The computation of the aggregate group research credit under these new temporary regulations is computed by treating all of the members of the group as a. The bank determines that during the 2015 tax year the business had an average number of 30 employees and that for the same tax year the businesss gross receipts were 3000000 and its assets consisted entirely of inventory and working capital. The objective of these rules is that when these determined amounts become relevant to the future computation of tax such determinations are to be binding.

Partnership Return of Income. Total income directly allocated 8. The discount rate is the interest rate charged to commercial banks and other depository institutions for loans received from the Federal Reserves discount window.

Political or Legislative Activities By Section 23701d Orgs. Erkan Rehber published Financial Analysis of Investment Projects Find read and cite all the research you need on ResearchGate. Net Operating Loss NOL Computation and NOL and Disaster.

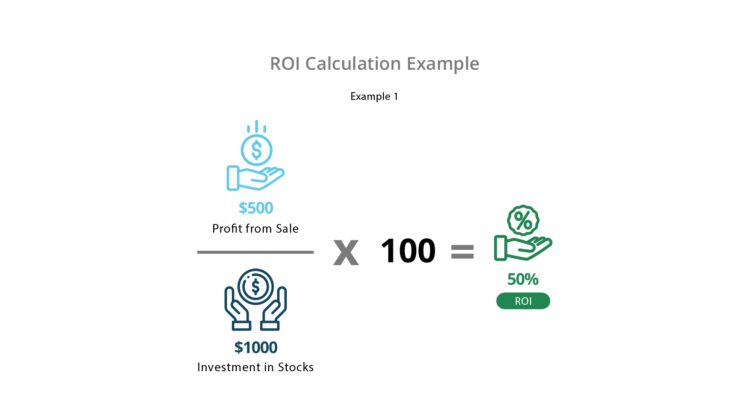

To give the investor their share to the companys profit. Suppose that the return on a portfolio during eight consecutive years was One dollar invested in the portfolio at the beginning of year 1 became 115 by the end of the year. The returns on fixed deposits are payable.

CA Exempt Organization Annual Information Return. Volatility profiles based on trailing-three-year calculations of the standard deviation of. However that is rarely the case in practice and each method of computing investment performance a basic return calculation a time-weighted return or a dollar-weighted return handles those cash flows differently.

Financial statement preparation investor return computation and regulatory reporting. Earlier it was in the 35 percent category. The internal rate of return sometime known as yield on project is the rate at which an investment project promises to.

Net Investment Income Tax NIIT. Investment income directly allocated 7. You can also sometimes estimate present value with The Rule of 72.

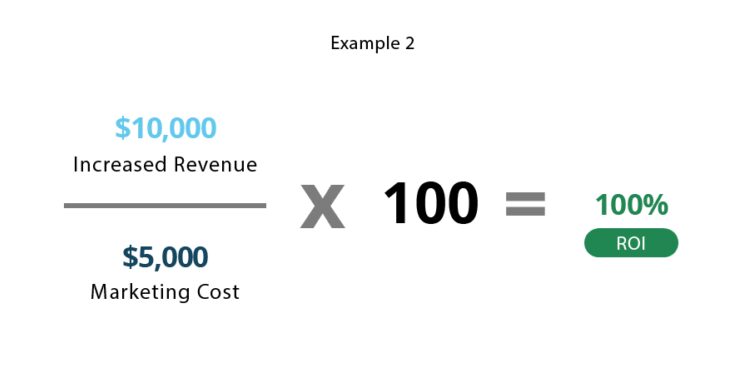

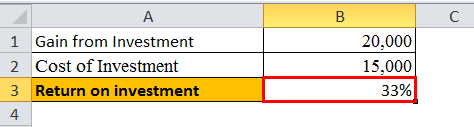

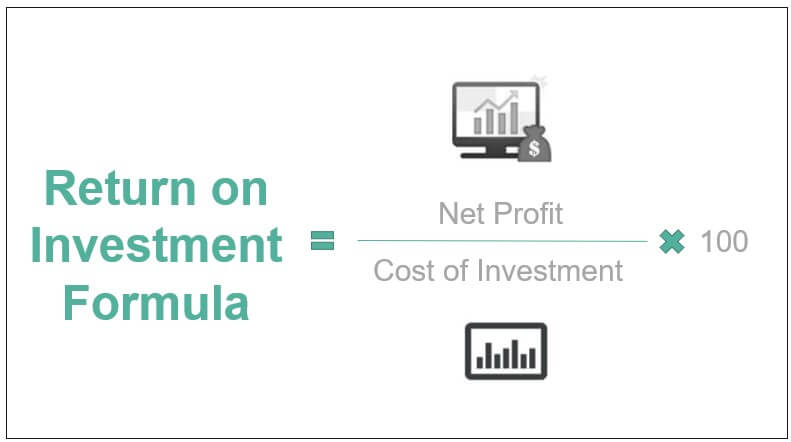

See How Finance Works for the present value formula. Return on investment ROI is a financial ratio that calculates the benefits an investor gets compared to the cost spent on a project. Also we mentioned the due date instructions and verification document.

Kane contributed further to tax. The geometric average return takes care of the outliers resulting from money inflows and outflows over time. Amended Corporation Franchise or Income Tax Return.

To attract potential investors. Income directly allocated to SC SC1120. Bank fixed deposits are guaranteed return investment plans which offer fixed return over the tenure of investment.

In case income computation is not available. The dividend is distributed in proportion to capital investment. If this 115 were reinvested in the same portfolio it would have become 109 115.

Like net present value method internal rate of return IRR method also takes into account the time value of money. The company now opted for a lower 25 percent tax.

Return On Investment Roi Definition Equation How To Calculate It

5 Easy Ways To Measure The Roi Of Training

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Definition Formula Roi Calculation

Calculating Return On Investment Roi In Excel

Return On Investment Analysis For An Investor Plan Projections

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Rate Of Return Formula Calculator Excel Template

What Is Roi Definition Formulas And Tips Snov Io

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

Return On Investment Roi Formula Meaning Investinganswers

How To Calculate Return On Investment Roi Free Premium Templates

Return On Investment Definition Formula Roi Calculation

Return On Investment Ratio Guide To Return On Investment Ratio

Return On Investment Roi Definition Equation How To Calculate It

Return On Investment Roi Formula And Calculator Excel Template

Roi Calculator Formula The Online Advertising Guide Ad Calculators