33+ mortgage payment based on income

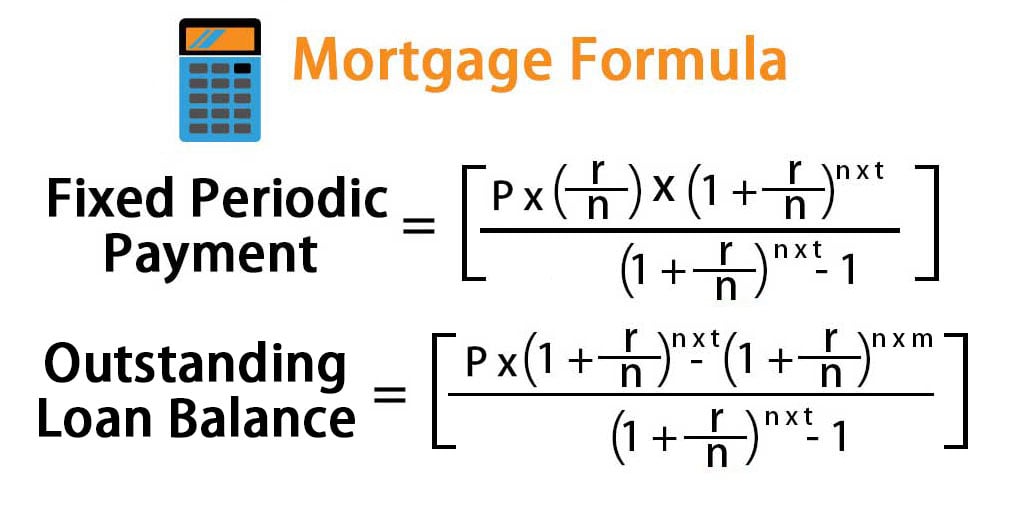

Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly. Web If you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt payments.

What Percentage Of Your Income To Spend On A Mortgage

Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000.

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

. Web A 325000 house with a 5 interest rate for 30 years and 16250 5 down will require an annual income of 82975. Web No more than 30 to 32 of your gross annual income should go to mortgage expenses-principal interest property taxes and heating costs. Web How much income is needed for a 300K mortgage.

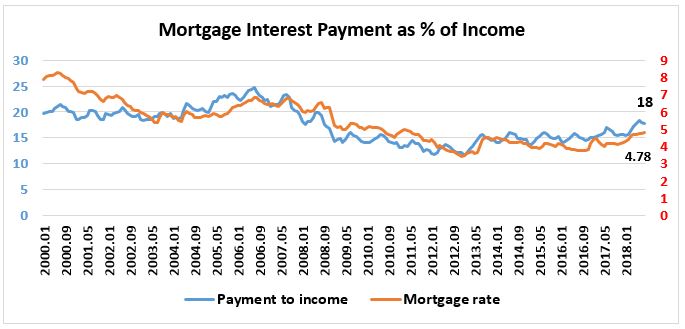

Web According to some experts if you are spending more than 30 of your pre-tax monthly income on mortgage payments then you may be at risk of mortgage stress. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web With minimum down payments commonly as low as 3 its easier than ever to put just a little money down.

5000 x 036 36 1800. There are options to include extra payments. Ad When Banks Say No We Say Yes.

Access Exclusive Mortgage Benefits For Service Members Veterans And Military Spouses. Were not including monthly liabilities in estimating the. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

To illustrate the average weekly income of full-time working adults in Australia is 1714 according to last Mays seasonally adjusted figures from the Australian Bureau of Statistics. Ad Choose the Right Amount to Borrow by Calculating Your Monthly Loan Payment. Web Mortgage affordability calculator Find out how much house you can afford with our mortgage affordability calculator.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Ad Estimate Your Monthly VA Mortgage Payment And Get Into A New Home With Competitive Rates.

Compare Offers From Our Partners To Find One For You. Lenders want to make sure these expenses dont exceed 36 of your monthly. What Is the 2836 Rule of.

Web Back-end DTI includes all of your debt payments in addition to the proposed mortgage payment. In that case NerdWallet recommends. Web The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages.

That largely depends on income and current monthly debt payments. But our chase home. Web The 2836 rule is an addendum to the 28 rule.

Web A mortgage payment on an average-price home with a standard 20 down payment 30-year mortgage now adds up to 31 of the median American households. Compare Offers From Our Partners To Find One For You. Get an estimated home price and monthly mortgage.

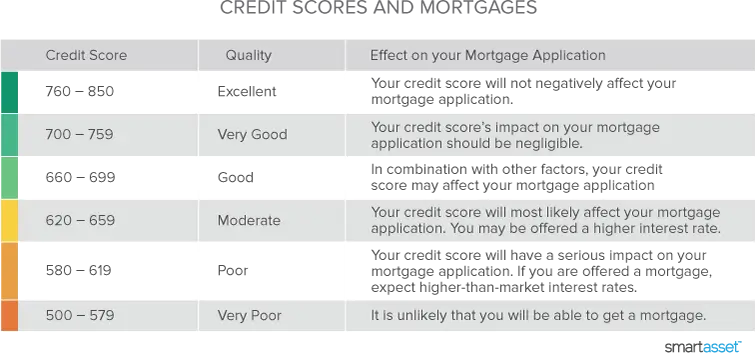

Web The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward debt payments including housing. Some mortgage lenders allow a higher debt-to-income ratio. The mortgage payment calculator can help you decide what the best.

If youd put 10 down on a 333333 home your mortgage would be about 300000. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Web The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

This includes credit cards car loans utility. Lowering your credit card debt is one way to lower your overall DTI. 28 of your income will go to your mortgage payment and 36 to all your other household debt.

Web Maximum Mortgage Calculator What is your maximum mortgage loan amount.

Home Loans Upto 20 Lakhs In Meerut City Meerut Lowest Interest Rates Apply Housing Loans From Top Banks In Meerut Justdial

How Much Mortgage Can I Afford Smartasset Com

How To Find Out If You Can Afford Your Dream Home

Annual Report 2003 2004

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

Mortgage Broker In Balmain Rozelle Five Dock Mortgage Choice

How Much Of My Income Goes Towards Housing Survey 1 Inc

Passive Real Listen To All Episodes Business Economics

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

Mortgage Formula Examples With Excel Template

The Percentage Of Income Rule For Mortgages Rocket Money

Will I Be Comfortable With A 550k House With A Salary Of 68k R Realestate

What Is A Mortgage Credit Carrots

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Annual Report 2003 2004

How Much Of My Income Should Go Towards A Mortgage Payment